The Singapore-based developer, which has already acquired a 5.5 per cent stake in AVJennings, has proposed to purchase the remaining shares at A$0.70 per share, exceeding Proprium’s November offer of A$0.67 per share, according to Forbes.

Ho Bee Land’s Chairman and founder, Chua Thian Poh, sees the acquisition as a strategic move to expand the company’s Australian presence.

“The proposed transaction represents a good opportunity for the group to enhance its scale and capabilities in Australia,” Mr Chua said.

“The merged Australian business will have a stronger financial position, increased revenue potential and enhanced business capability to compete on a national level.”

The takeover bid has already impacted AVJennings’ stock price, which jumped 7.8 per cent to A$0.69 following the announcement, though this remains below the company’s net asset value of A$0.81 per share.

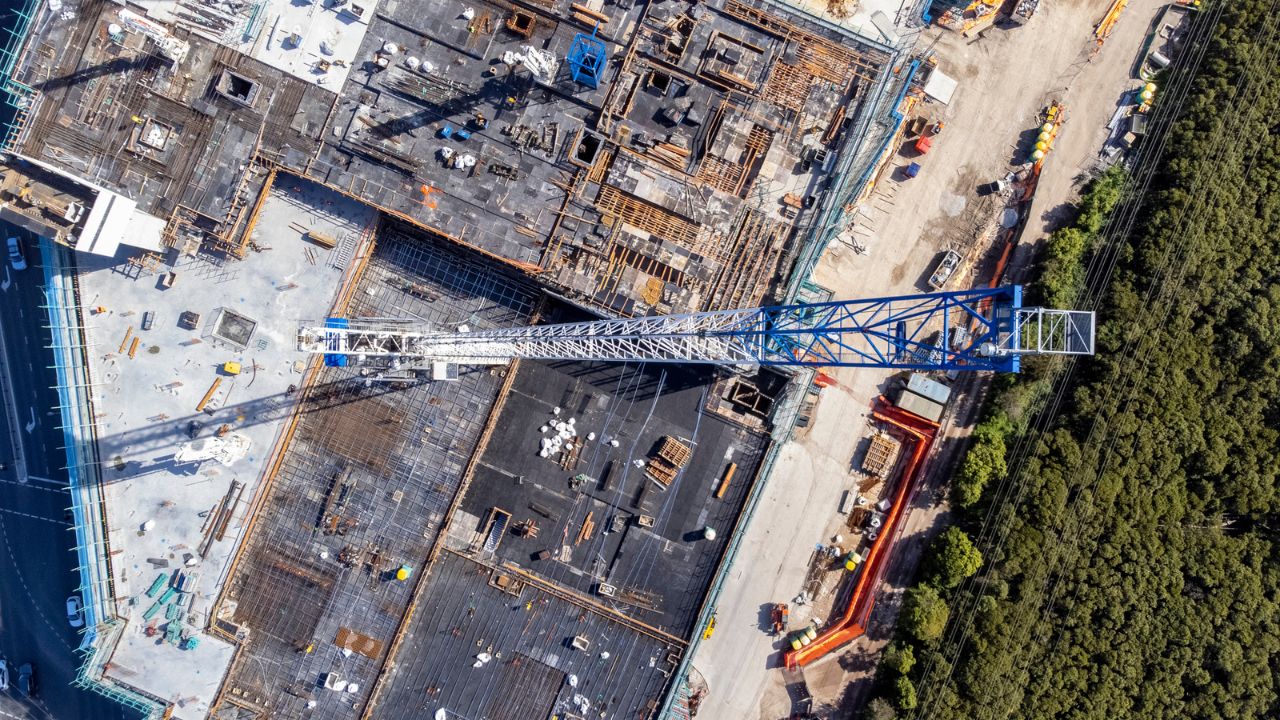

AVJennings’ portfolio includes a substantial land bank with the potential for approximately 10,000 new homes when fully developed, making it an attractive acquisition target in Australia’s tight market.

Ho Bee Land, which currently manages assets worth S$7 billion across Singapore, London, and Australia, sees the potential acquisition as a significant step in strengthening its position in the Australian market.

AVJennings said it still remains in discussions with Proprium and AVID, with its exclusivity and access remaining until January 31.

“The exclusivity arrangements with AVID included a fiduciary exception from the “no talk” and “no due diligence provisions to permit AVJennings to engage with a bona fide actual, proposed or potential competing proposal,” the company said last week.

“Following receipt of advice from AVJennings’ financial and legal advisors, the board of AVJennings have concluded the fiduciary exception applies to the Ho Bee Land proposal.

“As a result, AVJennings intends to provide due diligence access to Ho Be Land, subject to the parties entering confidentiality arrangements.”